Maximizing Your Business Potential with CCA Claims

In the realm of modern business, optimizing financial operations is crucial for long-term success. Among the vital strategies available to businesses is the effective utilization of CCA claims (Capital Cost Allowance claims). Understanding how to harness the full potential of CCA claims can not only enhance your asset management strategies but can also provide significant tax benefits that positively impact cash flow. This comprehensive article delves into the nuances of CCA claims, providing invaluable insights for financial professionals, accountants, and business owners alike.

What is a CCA Claim?

The Capital Cost Allowance (CCA) is a tax deduction that allows businesses to claim depreciation on their fixed assets over a specified period. This deduction is not only a way to account for the gradual decrease in value of an asset but significantly influences a company's taxable income. By claiming CCA, businesses can reduce their overall tax burden, freeing up capital for reinvestment or operational expenses.

The Importance of CCA Claims in Business

Understanding the intricacies of CCA claims is essential for any business looking to maximize profitability. Here are some key reasons why CCA claims are crucial:

- Tax Deduction Benefits: CCA claims offer tax deductions that lower taxable income and, consequently, the amount of tax payable, leading to improved cash flow.

- Asset Management: CCA helps companies better manage their fixed assets by promoting investment in newer technology and machinery, ultimately increasing operational efficiency.

- Planning for the Future: By understanding CCA deductions, businesses can make informed decisions regarding future investments and asset purchases.

- Improved Financial Statements: Active CCA claims can improve the overall assessment of financial statements, making companies appear more profitable and attracting potential investors.

How CCA Claims Work

To fully grasp the benefits of CCA, it’s essential to understand how it operates:

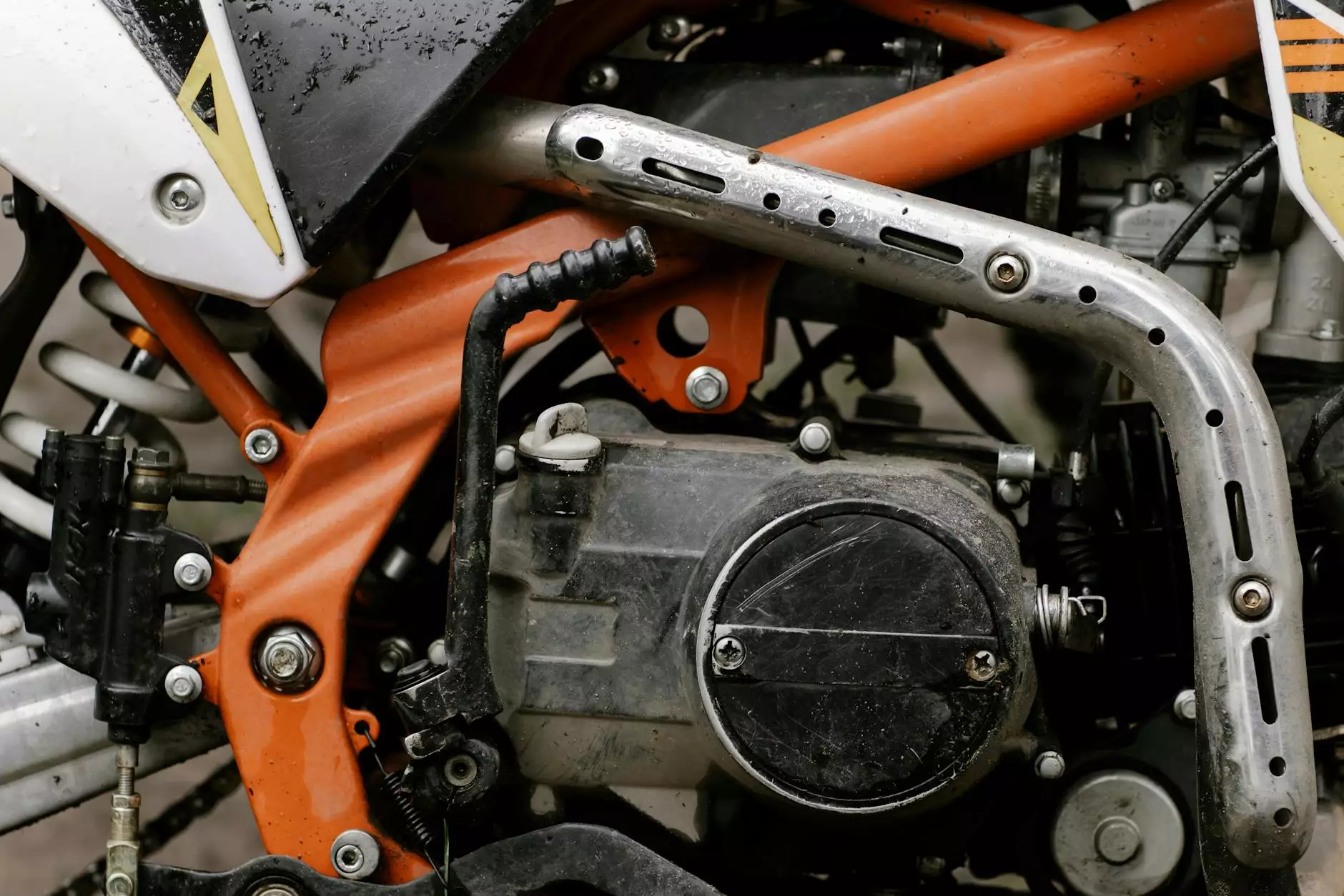

- Determine Eligible Assets: Not all assets qualify for CCA. Typically, assets such as machinery, buildings, and equipment qualify, while land does not.

- Classify Your Asset: Each eligible asset falls into a specific class defined by the Canadian Revenue Agency (CRA). Each class has its own depreciation rate.

- Calculate the CCA: The CCA is calculated based on a percentage of the net book value of the asset, which considers previous claims and any dispositions.

- File Your Claim: To benefit from these deductions, the claim must be included in the company's annual tax filings.

Types of CCA Classes

Assets are categorized into various classes, each with its specific CCA rate. Some common classes include:

- Class 1: Buildings - CCA rate of 4%

- Class 8: Furniture and Fixtures - CCA rate of 20%

- Class 10: Vehicles - CCA rate of 30%

- Class 50: Computer software - CCA rate of 100%

Strategies for Maximizing CCA Claims

To effectively leverage CCA for your business, consider the following strategies:

1. Accurate Record Keeping

Establish and maintain meticulous records of all asset purchases, including invoices and receipts. Accurate documentation is crucial for substantiating your CCA claims.

2. Optimize the Timing of Purchases

Time your asset purchases to maximize CCA benefits. For instance, purchasing an asset within the last quarter of the fiscal year can allow the business to claim a partial deduction for that year.

3. Consider Lease vs. Buy Strategies

Assess whether to lease or buy equipment. While purchasing allows for CCA claims, leasing could offer lower short-term costs and different tax treatment.

4. Utilize Available Resources

Engage with competent tax professionals who can provide insights and guidance tailored to your business’s specific situation. Their expertise can identify opportunities to enhance CCA claims.

Common Mistakes to Avoid with CCA Claims

While the benefits of CCA claims are significant, there are common pitfalls that businesses should avoid:

- Neglecting to Claim: Many businesses overlook their CCA claims entirely, missing out on valuable tax deductions.

- Incorrect Asset Classification: Misclassifying assets can lead to incorrect calculations and potential audits.

- Failing to Adjust for Disposal: When disposing of an asset, businesses must adjust their CCA claims accordingly or risk penalties.

The Future of CCA Claims in Business

As businesses navigate the complexities of financial management and compliance, the role of CCA claims will only continue to grow in importance. With ever-evolving tax regulations and financial strategies, keeping abreast of the latest changes and best practices in CCA claims is essential for sustained business success.

Conclusion

In conclusion, leveraging CCA claims is a strategic choice businesses can make to enhance financial health and operational efficacy. By understanding the intricacies of CCA, recognizing eligible assets, and employing effective strategies, businesses can maximize their tax benefits. For a detailed and tailored strategy on how CCA claims can apply to your unique situation, consider consulting with tax professionals at taxaccountantidm.com who specialize in financial services and tax optimization.