The Future of Investment Banking: Technology Trends that Transform the Industry

As the financial world continues to evolve rapidly, investment banking remains at the forefront of innovation. In this digital age, the convergence of finance and technology has unleashed a wave of transformative trends that are reshaping the landscape of the industry. Let's delve into the latest technology trends in investment banking and how they are revolutionizing the way financial institutions operate.

1. Artificial Intelligence (AI) in Investment Banking

Artificial Intelligence has emerged as a game-changer in investment banking, enabling firms to analyze vast amounts of data at unprecedented speeds and accuracy. AI-powered algorithms are revolutionizing risk management, trading strategies, and customer interactions. Through machine learning and predictive analytics, financial institutions can make data-driven decisions with greater precision and efficiency.

2. Blockchain Technology and Cryptocurrency

Blockchain technology, the backbone of cryptocurrencies like Bitcoin, has disrupted traditional banking processes by enabling secure, transparent, and instantaneous transactions. Investment banks are exploring the potential of blockchain for smart contracts, trade settlements, and cross-border payments. The decentralized nature of blockchain is revolutionizing how financial transactions are conducted, enhancing security and reducing operational costs.

3. Big Data Analytics for Smarter Insights

The proliferation of big data in investment banking has opened new avenues for extracting valuable insights and optimizing decision-making processes. By harnessing advanced analytics tools, banks can analyze market trends, customer behavior, and risk factors in real-time. Big data analytics empowers investment professionals to make informed decisions, improve operational efficiency, and mitigate risks effectively.

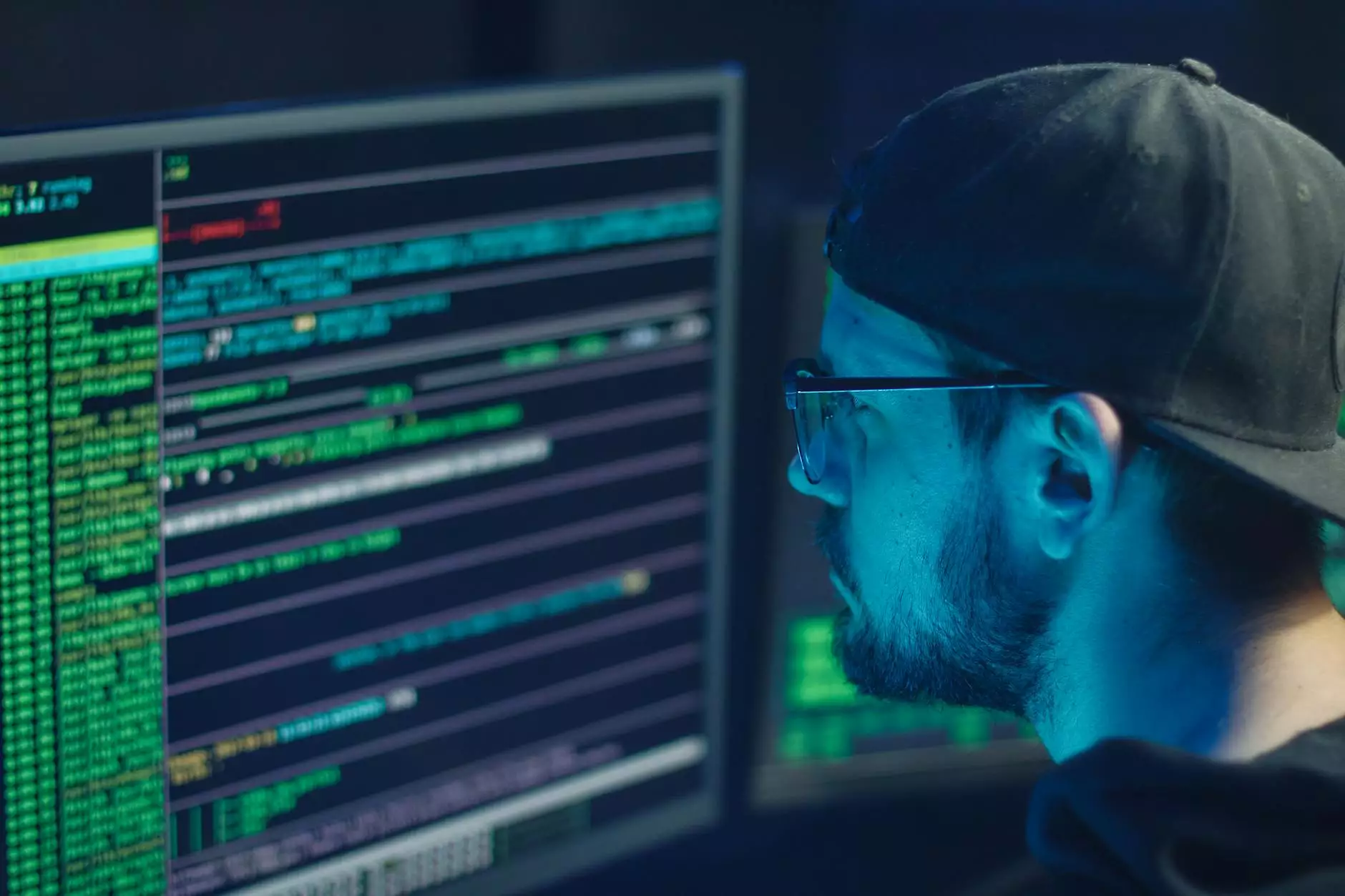

4. Cybersecurity Solutions for Enhanced Protection

With the rising threat of cyber attacks and data breaches, investment banks are prioritizing cybersecurity solutions to safeguard sensitive information and protect against potential threats. Advanced encryption technologies, biometric authentication, and real-time monitoring systems are being implemented to fortify the security infrastructure of financial institutions. Proactive cybersecurity measures are crucial in maintaining trust and integrity in the digital age.

5. Robotic Process Automation (RPA) for Efficiency

Robotic Process Automation (RPA) is transforming the operational efficiency of investment banking by automating repetitive tasks and streamlining workflows. RPA bots can perform routine activities such as data entry, compliance checks, and report generation with precision and speed. By deploying RPA solutions, banks can minimize human errors, reduce operational costs, and allocate resources more strategically.

6. Cloud Computing for Scalability and Flexibility

Cloud computing has become a cornerstone technology for investment banks seeking scalable infrastructure, data storage, and computing resources. Cloud-based solutions offer unparalleled flexibility, scalability, and cost-effectiveness, enabling banks to adapt rapidly to changing market conditions and customer demands. The adoption of cloud technology is revolutionizing the way banks manage data, facilitate collaboration, and enhance agility in a competitive landscape.

7. Fintech Partnerships Driving Innovation

Collaboration with FinTech startups and technology innovators is shaping the future of investment banking, fostering a culture of innovation and disruption. By partnering with FinTech companies, banks can leverage cutting-edge technologies, explore new business models, and deliver personalized services to clients. Fintech partnerships are enabling traditional banks to stay ahead of the curve and meet the evolving needs of a digital-first generation.

8. Quantum Computing for Advanced Analytics

The advent of quantum computing heralds a new era of advanced analytics and computation for investment banking. Quantum algorithms have the potential to revolutionize complex calculations, optimization processes, and risk modeling, offering unparalleled processing power and speed. As financial institutions harness the power of quantum computing, they can unlock new opportunities for innovation, strategic decision-making, and competitive advantage in a data-driven economy.

Embracing Innovation in Investment Banking

The convergence of technology and finance is reshaping the future of investment banking, unlocking unprecedented opportunities for growth, efficiency, and sustainability. By embracing the latest technology trends and harnessing the power of innovation, financial institutions can thrive in an increasingly digital and competitive landscape. As the industry continues to evolve, staying ahead of the curve and adapting to technological advancements will be essential for success in the dynamic world of investment banking.

Explore more insights on technology trends in investment banking and discover how your business can leverage cutting-edge solutions to drive growth and innovation.

technology trends in investment banking crossword